|

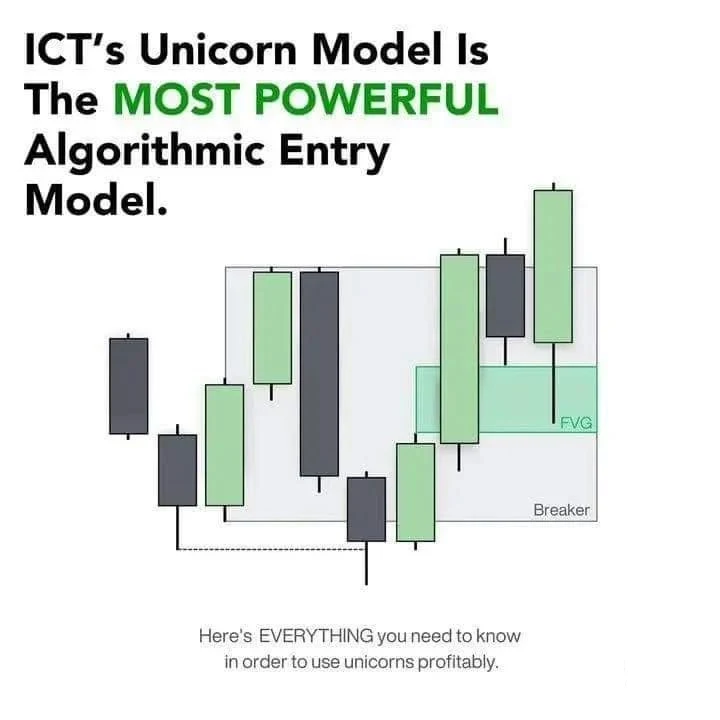

| Forex / ict - The Master ICT Unicorn Model |

|

| Forex / ict - The unicorn model consists of 3 main components - Time / A FVG / A Breaker Block |

|

| Forex / ict - Time / ICT's Killzones |

|

| Forex / ICT - Breaker Block |

|

| Forex / ict - Fair Value Gap FVG |

|

| Forex / ict - bullish unicorn model & bearish unicorn model |

The Master ICT Unicorn Model would appear to be an advanced trading strategy, especially in financial markets that are not widely known under standard terminology within the trading and investment world as of my last update. Drawing from keywords, I can, however, hazard a guess at what such a model would be about within the wider context of trading, ICT, and algorithmic market strategy. Specific building blocks of the "Master ICT Unicorn Model"

ICT in Trading: These are technologies and systems deployed for market analysis, execution, and risk management

|

| Forex / ict - orb risk management |

in a financial market context. It may be applied in terms of:

Algorithmic trading: automating trading decisions based on a pre-programmed set of criteria

|

| Forex / ict - Algorithmic trading - algo trading |

Data Analytics: Big data, machine learning, and AI will help in making better trading decisions. This is done by forecasting market trends

|

| Forex / ict - trend continuation setup |

and patterns.

|

| Forex / ict - candle patterns |

Connectivity: Availing high-speed connectivity and secure platforms for their quick and convincing execution.

"Unicorn" in Trading: It refers to a term most often used in business to define a privately held company whose valuation exceeds US$1 billion. In trading terms, the "unicorn" model could be interpreted as a phenomenally successful or rare trading strategy that has the potential to provide returns that are exceptionally good, hence rare or "mythical" in nature, while taking positions in the markets.

Master Model: A "Master" model in this context could define an optimized holistic system of tools, technologies, and strategies put together for the best possible execution. This may involve the following:

Risk management: Ensuring trades are executed in a manner that limits downside risk.

|

| Forex / ict - Risk Reward Ratio |

|

| Forex / ict - Master ICT Kill Zones For Smarter Trading! |

Trade execution algorithms are complex algorithms making trading decisions and exercising the trades without human intervention. It optimizes on price and speed.

|

| Forex / ICT - Price Action |

|

| Forex / ICT - Spread |

Core Components of the Model

Real-time Market Analysis: The model would use advanced analytics with real-time market data. Advanced machine learning models can process a great amount of financial data to project price movements, trends, and possible volatility.

Automation of Trade Execution: One of the major elements that the "Unicorn" model can possess is executing a trade efficiently and swiftly. The algorithmic trading strategies here would include high-frequency trading or market-making strategy, which is designed to achieve profits from small price differences over a large number of trades by leveraging the scale and frequency of the transactions.

Optimization of Trade Parameters: The model might leverage optimization algorithms to fine-tune trade parameters—such as stop-loss levels, position sizes, and entry/exit points—to adapt to changing market conditions.

Risk Management: The model would, in all likelihood, use advanced strategies of risk management. For instance, there could be a preset limit to the amount of loss-especially when market volatility rises rapidly, diversification or hedging might be used to dampen these swings.

Liquidity and Slippage Management: Ensuring liquidity and minimizing slippage-the difference between the expected and actual trade prices-would be critical.

The model could prioritize liquidity-sensitive strategies to minimize the cost of executing large trades in volatile or low-volume markets.

Backtesting and Simulation: The model would be subjected to extensive backtesting, a process in which the model was tested on historical data to measure its performance before actually deploying it into live trading. It could also be refined using simulation environments under various market conditions.

Use Cases of the Model

Institutional traders could be big financial institutions that may use such a model to automatically do the trading strategy with the purpose of improving the speed of response with very little human intervention.

Retail Traders: Although originally developed for institutional use, this model can also be applied to retail traders with access to sophisticated trading platforms and tools.

|

| Forex / ICT - RETAIL vs SMC |

Hedge Funds and Proprietary Trading Firms: These organizations could use the model to create high-frequency or market-neutral strategies that assure regular returns.

Conclusion

The Master ICT Unicorn Model would be an integrated high-level trading framework using the best available technologies for market analysis, risk management, and automated trade execution. It would represent a high-performance adaptive system that is meant to take advantage of market inefficiencies and trends, thus offering the trader a possible extraordinary advantage in a very challenging trading environment.

The term "unicorn" here might imply the rarity and exceptional nature of the model, perhaps a strategy returning outsize rewards as opposed to that of the general market order.

If this is a particular model you are referring to or part of a proprietary system, more information would be helpful in defining the structural elements and objectives.

|

| Forex / ICT - Unicorn entry with HTF Bias & narrative |