|

| types of fair value gaps fvg |

The ICT Implied Fair Value Gap is grounded in market structure and price action. It targets discrepancies between the perceived fair value of a currency pair and its current price. For example, if the EUR/USD pair is trading at 1.1000 but analysis suggests its fair value is closer to 1.0900, this creates an opportunity. The market might be overvalued, hinting at a possible price correction back to the fair value.

The foreign exchange market is fast-paced, offering traders countless opportunities. However, these chances come with challenges. One valuable concept that can provide a trading edge is the ICT Implied Fair Value Gap (IFVG). This concept highlights price points in the market that may signal inefficiencies. By understanding the IFVG, traders can rethink their strategies and make more informed decisions.

What is the ICT Implied Fair Value Gap (IFVG)?

Recognizing the framework of the IFVG helps traders determine optimal entry and exit points. The belief here is simple: prices usually return to a state of balance. This makes IFVG especially useful for those focused on market inefficiencies.

Why is the IFVG Important for Forex Traders?

|

| strong break with FVG & break without FVG |

Understanding the ICT Implied Fair Value Gap has multiple benefits for forex traders.

Firstly, it provides a lens through which one can determine whether a currency pair is trading low or high. This is particularly vital because the forex market can be volatile with price swings exceeding 1% in a single day.

|

| strong break with FVG & break without FVG |

Lastly, the IFVG fosters disciplined trading. By adhering to systematic strategies, traders can reduce emotional responses that often lead to mistakes.

How to Identify the IFVG in Forex Markets

Spotting the ICT Implied Fair Value Gap

|

| How to Identify the IFVG in Forex Markets |

involves technical skills and a solid grasp of market dynamics.

Step 1: Analyze Historical Price Data

Start by examining historical price data. Identify price levels that have acted as strong support or resistance in the past. For instance, if the USD/CAD pair repeatedly bounces off 1.2500, this price level is worth monitoring when the price approaches it again.

Step 2: Apply Technical Indicators

Technical indicators are effective tools for detecting IFVGs. Utilizing tools like Fibonacci retracements or Moving Averages can provide insights into price trends. For example, if a currency pair reaches a Fibonacci level of 61.8% and begins to reverse, it can indicate an implied fair value gap that traders might capitalize on.

Step 3: Combine with Fundamental Analysis

Integrating fundamental analysis adds depth to your technical findings. Keep an eye on economic indicators like inflation rates, GDP growth, and central bank interest rate changes. For example, if a country’s employment data shows a significant increase, it could strengthen its currency, aligning with any technical gaps you've identified.

Practical Trading Strategies Utilizing IFVG

After identifying the ICT Implied Fair Value Gap, here are some strategies traders can use effectively:

Strategy 1: Trend Continuation

When the market moves strongly in one direction away from an established fair value, traders may consider trend continuation strategies.

|

| Trend continuation |

Strategy 2: Reversal Trading

Reversal trading is powerful when working with the IFVG.

|

| Valid & Invalid Reversal |

Strategy 3: Breakout Confirmation

A breakout through an established IFVG often indicates trend continuation.

|

| Breakout confirmation in forex |

Traders can capitalize on these movements. Nevertheless, adhering to proper risk management is critical, as breakouts can result in false signals. Recent studies show that nearly 50% of breakouts can lead to reversals within the next 24 hours, emphasizing the importance of caution.

Managing Risk While Trading IFVG

|

| Managing risk while trading IFVG |

Use of Stop-Loss Orders

Implementing clear stop-loss orders is vital. For example, if entering a trade near a fair value gap of 100 pips, set a stop-loss approximately 20-30 pips beyond that gap.

|

| Placement of stop loss of forex |

This protects capital while allowing a chance for potential profits.

Position Sizing

Effective position sizing minimizes risk. A common guideline is to risk no more than 1-2% of your total capital on each trade.

|

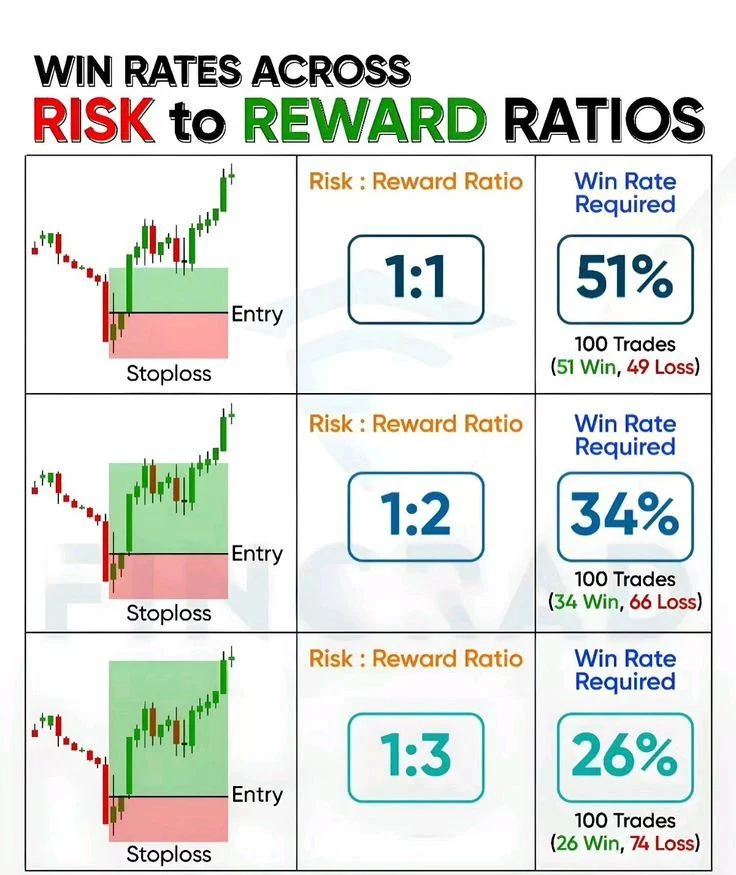

| Win rates across risk reward ratios |

For instance, if a trader has a capital of $10,000, risking $100 to $200 per trade ensures sustainability over time.

Continuous Learning and Adaptation

The forex market changes daily. Staying updated on market trends and economic news is crucial. Adapting your approach as needed will enhance your decision-making when utilizing the IFVG.

Final Thoughts

The ICT Implied Fair Value Gap is a valuable tool for forex traders looking to exploit market inefficiencies.

|

| valid bullish fvg |

By accurately identifying and applying IFVGs, traders can make better-informed decisions that improve their strategies.

|

| valid bearish fvg |

|

| inversion fair value gap fvg |

In the rapidly evolving world of forex trading, adaptability and a willingness to learn are essential. Embracing concepts like the ICT Implied Fair Value Gap can provide traders with the insights necessary to make effective trading decisions.