Timing is everything in the fast-paced world of forex trading. Traders are always on the lookout for a reliable way to enhance their strategy and make informed decisions. Among the concepts gaining traction, especially among those following the ICT methodology, is Macro Times. The guide will explain what ICT Macro Times are, why they are important, and how traders can effectively incorporate them into their trading strategy.

What are ICT Macro Times?

|

| ICT Micro Times - how to use them a thread |

The ICT Macro Times refers to those specific times during the day when the market gets intense. These are usually when key economic events occur, significant news releases are published, or the overlap of crucial trading sessions. Understanding them helps forex traders to take advantage of market volatility and increase their likelihood of profit.

The identification of ICT Macro Times enables traders to adapt more precisely, make their trading in tune with the market's movement, and thereby be more successful.

|

| Forex / ict micro times |

The Importance of Macro Times

Recognizing and utilizing ICT Macro Times can lead to several advantages:

Heightened Volatility:

Forex / ict - high volatility vs low volatility

Forex markets become highly volatile during such periods.

Forex / ict - high volatility vs low volatility

For example, the NFP report, which comes out on the first Friday of every month, can easily move the price by more than 100 pips in the major currency pairs.Liquidity:

Forex / ict - liquidity structure

During the ICT Macro Times, liquidity is usually higher.

Forex / ict - CHoCH Entry & liquidity

According to research, during high liquidity times, the speed of order execution is as high as 80% faster,

Forex / ict - liquidity Concept

reducing slippage and increasing overall trading performance.Market Sentiment: Many of these Macro Times coincide with key data releases or geopolitical events, and this brings immense clarity into market sentiment and direction.

Forex / ict - market sentiment

A very good example could be the interest rate announcements by central banks resulting in abrupt changes in markets.

Knowing the Macro Times helps a trader to be better positioned in the dynamic market and to readjust their strategies to maximize their gains.

Key ICT Macro Times to Watch

Major Economic Releases

Significant economic announcements heavily influence forex market behavior. Key events include:

Non-Farm Payrolls (NFP):

Forex / ict - non farm payrolls ( NFP )

Typically released at 8:30 AM EST on the first Friday of each month.

Forex / ict - how to trade the ( NFP )

Historically, the NFP report has caused USD pairs to experience price fluctuations averaging 150 pips.

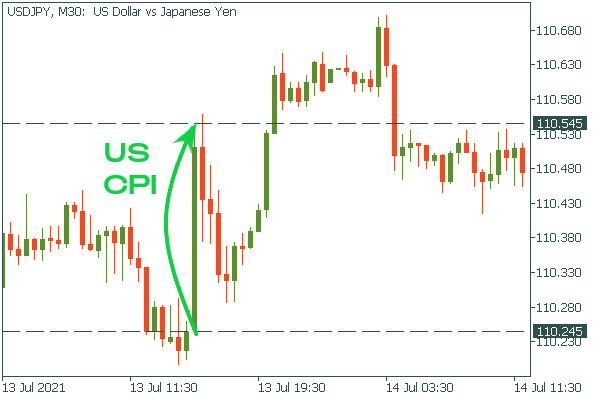

Forex / ict - how to trade the ( NFP ) Consumer Price Index (CPI): Monthly releases impact inflation expectations.

Forex / ict - consumer price index ( CPI )

For example, a deviation from the forecast by just 0.2% can lead to substantial market movement.

Forex / ict - consumer price index ( CPI )

Traders should be prepared for these periods, ready to adjust their positions and manage risks effectively.

Session Overlaps

The overlap between major trading sessions, especially London and New York, is a vital Macro Time.

|

| Forex / ict - major trading sessions |

This overlap happens from 8 AM to 12 PM EST and often sees significant market activity.

During these hours, trading volumes can increase by as much as 60%, making it a prime opportunity for traders to capitalize on rapid price changes and improved spreads.

Time of Day Analysis

Different times of day can reveal various trading opportunities. For instance, the first two hours of the London session are typically more volatile. Conversely, the late Asian session may see reduced activity.

Recognizing these patterns can help traders optimize their schedules for better entry and exit points. Traders who act during high-volatility periods can maximize profit potential.

Incorporating ICT Macro Times into Your Trading Strategy

To effectively use ICT Macro Times, traders should consider these practical steps:

Create a Trading Calendar: Track key economic releases and session overlaps. A comprehensive calendar helps anticipate volatility and adjust trading plans accordingly.

Implement a Risk Management Plan: Given the volatility during the Macro Times, having a robust risk management strategy is critical.

Forex / ict - implement a risk management plan

Utilize stop-loss orders and determine appropriate position sizes to safeguard against unexpected market movements.

Forex / ict - placement of stop loss Analyze Historical Data: Review past market behaviors during significant Macro Times. Analytics can reveal trends and help predict future price actions, empowering traders to make well-informed decisions.

Stay Updated: Continuous monitoring of market news is vital. Unexpected events can cause sudden price shifts. Keeping informed ensures traders can react swiftly to changes.

The Role of Technical Analysis

Technical analysis aids in understanding and optimizing trades during ICT Macro Times. Using indicators

.jpg) |

| Forex / ict - moving average indicator - trading strategy |

like moving averages, support and resistance levels

|

| Forex / ict - support and resistance levels |

and momentum indicators

|

| Forex / ict - momentum indicators |

can enhance a trader’s ability to navigate these high-activity periods effectively.

Challenges of Trading During ICT Macro Times

While Macro Times offer multiple benefits, they also present challenges:

Overtrading Risks: The temptation to trade excessively can lead to emotional decision-making. Maintaining discipline during highly volatile

Forex / ict - high volatility vs low volatility

periods is essential.News-Related Whipsaws: Economic data releases can cause sudden price reversals.

Forex / ict - valid & invalid reversal

Traders must remain alert and ready to adapt to unexpected market movements.Spread Widening: Volatile periods may lead to increased spreads, which can affect profitability.

Forex / ict - spread

Account for potential spread fluctuations in your risk management plans.

Final Thoughts

Understanding the ICT Macro Times

|

| Forex / ict - Understanding the ICT Macro Times |

is important to the forex trader in managing the complexity of the market. In fact, with the ability to identify the optimal periods for volatility and higher liquidity the trader will be able to work on perfecting his or her strategy and, in turn, his or her overall performance.

|

| Forex / ict - Liquidity |

The inclusion of Macro Times into the daily trading routine brings about awareness and orderly procedure in conducting trade. Proper preparation, knowledgeable analysis, and disciplined execution will let the trader make wiser decisions during these important market events.

Leveraging ICT Macro Times equips forex traders with a competitive edge in an ever-changing marketplace.